Is Ma Yun Completely Invisible? Ali'S Financial Report In The First Quarter Of Fiscal Year 2022 Transmits Three Signals

Alibaba, which has received much attention, has handed over its latest financial report.

On the evening of August 3, Alibaba Group announced the first quarter of fiscal year 2022. As of June 30, 2021, the annual active consumers of Alibaba ecosystem reached 1.18 billion, an increase of 45 million compared with the previous quarter, of which 912 million consumers came from the Chinese market. This quarter, Alibaba Group's revenue increased 34% year on year. Without considering the impact of the merger of Gaoxin retail, the revenue increased by 22% year on year. Non GAAP free cash flow was RMB 20.683 billion (US $3203 billion), a decrease of 43% compared with the same period in 2020, mainly due to the decrease of profit caused by RMB 9.114 billion used to pay part of anti-monopoly fines and investment in key strategic areas and growth business.

Just last week, Alibaba group submitted its 20f file and financial report for 2021 to the securities and Exchange Commission and the Hong Kong stock exchange. In the list of shareholders, Softbank is still the largest shareholder of Alibaba, holding 24.8% of shares. However, since Ma Yun, founder of Alibaba, no longer serves as an executive and director of the company, the shareholding ratio has not been disclosed.

In fact, after Ma Yun leaves office, Alibaba's management has been handed over to Zhang Yong and his partner system. From the financial report point of view, there are at least three signals worthy of attention: first, alibaba will still lay out more tracks in the future, and Ma Yun will be more completely invisible; 2、 Even if there is a loss, it is still necessary to increase investment in new businesses such as community business platform, taote and local life services; 3、 In the context of antitrust, alibaba will continue to reduce the operating costs of platform merchants in the future. At the same time, ant group will make more profits to the real economy.

Directors and executives hold 2.3%

Since the listing of ant financial services was suspended in 2020, Ma Yun has become very low-key in the whirlpool of public opinion, and rarely appears in the public eye. This time, Ma Yun's shareholding ratio is no longer disclosed, also expressed a low-key attitude. At present, Alibaba's directors and executives hold 2.3% of the shares, which is not a high proportion from the perspective of the general corporate structure. According to the financial report, in the 12 months ending March 31, 2021, Alibaba's revenue has reached about 717.289 billion yuan, with a year-on-year increase of about 40%; The net profit attributable to shareholders reached 150.578 billion yuan, a slight increase of less than 1% year on year. In the list of net profits of Chinese enterprises in 2020, the four major state-owned banks still occupy the top four, while Tencent and Alibaba rank fifth and sixth respectively.

At present, Alibaba has 38 partners, six of whom are members of the Partnership Committee, namely, Ma Yun, Cai Chongxin, Zhang Yong, Jing Xiandong, Peng Lei and Wang Jian. It is these six who can elect partners. Among them, Cai Chongxin holds 1.4%. However, Ma Yun's stock reduction has always been publicly disclosed. On July 2, 2020, Ma Yun's shareholding ratio decreased from 6.1% at the beginning of the year to 4.8% and reduced by 1.3%. According to the market value at that time, it was about 40 billion yuan. In response, Ali said that Ma Yun is no longer a director of the company and has not managed any administrative affairs, so the annual report does not need to disclose his shareholding.

At the same time, Alibaba also announced that it will expand a "share repurchase plan" from $10 billion to $15 billion, which is the largest repurchase plan in the history of Alibaba group. It is reported that on December 28, 2020, the board of directors of Alibaba Group authorized the repurchase of US $10 billion of American Depository Receipts. The move is seen as confident of its long-term future development, which will last until the end of 2022.

Focus on consumption and industrial circuit

In the 12 months ending June 30, 2021, the number of consumers in Alibaba's Chinese retail market continued to increase steadily, with annual active consumers reaching 828 million and mobile monthly active users increasing by 14 million to 939 million in a single quarter. The future oriented investment layout has been effective, and new business has become a new engine to promote growth and expand the consumer base. Through direct cooperation with manufacturers of origin, taote designs and produces products with higher quality and cost performance, with annual active consumers increasing to over 190 million; The idle fish platform provides consumers with a wealth of idle, rental and retro products, with more than 100 million mobile monthly active users in this quarter.

In addition, this quarter, Alibaba upgraded its community business platform business to provide better services for consumers in low-level cities and rural areas, and the volume of commodity transactions increased by about 200% month on month. So far, the digital supply chain capability of stable supply of fresh, agricultural products and various fast-selling products, together with the perfect performance service system of one hour delivery, half day delivery, the same day delivery and the next day self delivery, Alibaba's services in the field of consumption are more diversified.

Last week, Zhang Yong stressed in a letter to shareholders that it is Alibaba's very important orientation and direction to become a company that integrates consumer Internet and industrial Internet better. This quarter's financial report shows that after years of precipitation, cloud computing, rookie network, etc., have served the digitization of various industries and participated in the construction of digital infrastructure of the whole society. The industrial Internet has become a new flywheel driving Ali's future growth. Alibaba cloud's revenue in this quarter increased to 16.051 billion yuan year-on-year, and achieved profits for the third consecutive quarter, with adjusted EBITA of 340 million yuan. Rookie network achieved 50% steady revenue growth, and the order volume of rookie wrapping increased 63% year on year. However, due to fines and new business investment, Alibaba's operating profit this quarter decreased by 11% year-on-year.

Ant net profit decreased month on month

In addition to Alibaba, ant group's performance data is also reflected in this financial report. Data shows that from January to March this year, Alibaba Group's investment income from ant group was 4.494 billion yuan, down from 7.182 billion yuan in the fourth quarter of 2020, reflecting the decline of net profit of ant group in the first quarter of this year.

In this regard, Southwest Securities overseas chief analyst Chen Zemin said that this is mainly affected by seasonal factors and the implementation of rectification measures. As Alibaba group delayed the confirmation of investment profit and loss for a quarter, the financial report showed that the investment income from ant group actually came from January to March this year. This data shows that the ant group in the rectification period had a decline in net profit in the first quarter. At present, Alibaba holds 33% of the shares of ant group. At the beginning of November last year, the listing of ant group was postponed, and a rectification working group was set up at the end of December, and began to formulate the rectification plan and work schedule. On April 12 this year, ant group announced that under the guidance of the financial management department, it has completed the research and development of rectification plan by comprehensively benchmarking regulatory requirements.

Chen Zemin believes that ant group's profit declined month on month in the first quarter of 2021, which is mainly affected by seasonal factors and rectification. First of all, the first quarter is often a period when the annual revenue of each company is relatively low; Secondly, ant group is in the period of rectification and business adjustment, which has an impact on financial performance. According to the previous media statistics, ant group will have a new measure every eight days from the IPO suspension in November last year to the middle of March this year, of which about 40% is related to rational consumption and lending, and 25% is related to platform specification and consumer protection, including the adjustment of the quota of some young users by Huabei. In addition, Alipay, a subsidiary of ant group, has taken the lead in reducing fees for small and micro enterprises and individual businesses in the industry and making profits to the real economy.

Recently, Alipay announced that in the next three years (until September 30, 2024), for all Alipay code merchants, cash collection and withdrawal will continue to be free of charge, and there is no single upper limit or one-day upper limit for withdrawal; For small and micro enterprises, individual businesses and individuals with business behaviors that meet the standards, 10% discount will be given to online payment service fee from August 1. Previously, ant group said that under the guidance of the financial management department, it would conscientiously implement the rectification work, ensure the comprehensive standardization of the operation and development of financial business, and at the same time fully guarantee the business continuity and service quality, and continuously improve the service level for the real economy, small and micro enterprises and consumers.

- Related reading

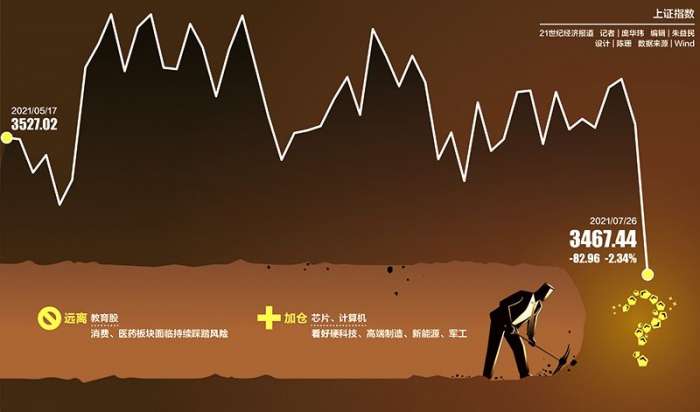

A Shares In Two Days "Evaporation" Of 4 Trillion Market Value Of Foreign Capital Fleeing Private Placement Passive Reduction

|

After A-Share Crash, Institutional Bottom Copy Roadmap Emerges: Away From Education Stocks, Favor "Ning Index"

|

China Securities Regulatory Commission And National Development And Reform Commission Re Discuss Trillion Reits Market

|- regional economies | Domestic Cotton Price Rises Sharply, Profit Space Faces Challenge

- Local hotspot | Huaibin Boosts Industrial Cluster Zone To "The Largest Chemical Fiber Textile Base In Central And Western China"

- Management strategy | After "Independence", Can Vimy Return To Its Peak?

- Listed company | Shenda Shares ((600626): Shareholding Ratio Of Controlling Shareholders Increased To 46.98%

- neust fashion | Kapok Road | Hibiscus Is Not As Good As Beauty Make-Up

- Exhibition video | Shenzhen Fashion Exhibition: Exclusive Interview With Mr. Li Xinyun, Director Of Jiangxi Ningdu Industrial Park

- Show fair | Zhishan Sports: A Different Show In 2021 Shenzhen Fashion Show

- regional economies | India Extends Textile Export Tax Rebate Until March 31, 2024

- regional economies | Vietnam'S Textile Industry Has Been Hit Hard By The Epidemic

- Equipment matching | China'S Dilemma Faced By Swiss Textile Machinery Industry

- The Balance Between The Development Of Online Games And The Protection Of Minors

- With 16.8 Billion Cash In Hand, Zijin Mining Wants To Distribute Lithium, The Global Core Resources Have Been Divided Up, How Does The First Brother Of Nonferrous Metals Break The Situation

- 24.3 Billion Financial Loss Black Hole Detonates Sui Tianli'S Loss Of Contact

- Design Guidance For Women'S Clothing In Spring And Summer 2022 (Part 1)

- Vietnam'S Textile And Clothing Exports Increased By 21% In The First Half Of The Year

- Postponement Of 2021 Forum On China'S Garment Regional Cooperation And Development

- Huaibin Boosts Industrial Cluster Zone To "The Largest Chemical Fiber Textile Base In Central And Western China"

- India'S Cotton Price Soars And Textile Industry Suffers

- Review Of China'S Clothing Export In The First Half Of The Year And Prospects For The Second Half Of The Year

- The Rapid Rise Of Local Cotton Prices In India Has Aroused Concerns From All Walks Of Life