China'S Former Richest Man Shi Zhengrong Fights Capital Market Again

On November 25, the IPO application of Asia silicon (Qinghai) Co., Ltd. was accepted by the Shanghai Stock Exchange, becoming the first company in Qinghai Province to rush into the science and technology innovation board.

For investors who understand the history of the photovoltaic industry in the past 20 years, the Asian silicon industry is not a strange name. At the beginning of the 20th century, Wuxi Shangde, a leading photovoltaic industry leader, was inextricably related to it.

Shi Zhengrong, founder of Wuxi Suntech, is the real controller behind the listing of Asia silicon. Shi Zhengrong was once the richest man in China by virtue of Wuxi Suntech, and he was also known as "godfather of photovoltaic industry in China". However, due to the bankruptcy and reorganization of Wuxi Suntech, Shi Zhengrong lost his vision. After several years of ups and downs, the Asian silicon industry launched an impact on the science and technology innovation board, and Shi Zhengrong's return attracted a lot of market attention.

According to the prospectus, Asia's Silicon owners are engaged in the R & D and production of polysilicon materials, the operation of photovoltaic power stations, and the R & D and manufacturing of electronic gases. They are the upstream leaders of the photovoltaic industry chain. Their main customers are well-known enterprises such as Longji, Jingao technology and Zhonghuan, which are the hot targets of a shares.

Shi Zhengrong's escort, as well as many photovoltaic industry leaders "buying", has added a lot of highlights to the IPO path of Asia's silicon industry.

Silicon industry leader

The business of silicon owners in Asia includes the R & D and production of polysilicon materials, the operation of photovoltaic power stations, and the R & D and manufacturing of electronic gases. Among them, the R & D and production of polysilicon materials is the company's main business, accounting for more than 80% of the operating revenue.

What is the position of silicon industry in Asia? According to the prospectus, the company is one of the first batch of modern polysilicon material technology R & D and product production enterprises in China, which are designed and put into production for the first time with independent process package design. It is also a leading supplier of high-purity silicon materials in the industry. In 2019, the polysilicon output of Asia's silicon industry is 19358.82 tons, accounting for 3.8% of the world's polysilicon production. It is the top 10 enterprises in the world in terms of polysilicon production capacity, ranking eighth.

In the list of Asian silicon customers, there are a series of companies familiar with the market: Longji, Jingao technology, Zhonghuan, Trina Solar, etc. In recent years, Longji, a "big bull stock" in the photovoltaic field, has risen to be the company's largest customer. In 2018, 2019 and the first half of this year, the sales revenue from Longji shares accounted for 20.09%, 40.73% and 69.72% respectively. The second largest state grid Qinghai electric power company is also the company's supplier, and its sales business is mainly photovoltaic power generation.

It can be seen from the above-mentioned materials that polysilicon materials are mainly used in the photovoltaic industry in Asia.

At present, the semiconductor industry is booming, and the demand for upstream silicon materials is growing. This market change has prompted the Asian silicon industry to actively explore the research and development of polysilicon materials for semiconductors. And this project is the addition of its semiconductor business direction.

According to the prospectus, Asia silicon plans to issue no more than 88.5417 million shares and plans to raise 1.5 billion yuan for 60000 T / a electronic grade polysilicon phase I project. After the successful implementation of the project, Asian silicon industry can produce 30000 tons of electronic grade II or above polysilicon, effectively filling the gap of domestic electronic grade polysilicon market demand.

In terms of specific uses, the company's raised investment project construction is to meet the requirements of silicon materials for n-type high-efficiency photovoltaic cells on the basis of fully mastering the production technology of silicon materials for n-type high-efficiency photovoltaic cells. It is reported that the company has officially passed the verification of n-type battery materials of Longji Co., Ltd. this year, and has become the first supplier of polysilicon enterprises in China to pass the verification.

In August this year, the Asia project mobilization conference was launched. Local media in Qinghai Province reported that the successful commissioning of the project will change the situation of China's dependence on import of basic materials for integrated circuits, which is of great significance for ensuring the safety of basic materials for large-scale integrated circuits and the industrialization of key materials in key fields.

Price fluctuation of polysilicon

When it comes to the past and present life of silicon industry in Asia, Shi Zhengrong and Wuxi Suntech are unavoidable names.

At present, the actual controllers of the company are Shi Zhengrong and his wife Zhang Wei. The former was a man of the day in China's photovoltaic enterprises. In 2000, Shi Zhengrong founded Wuxi Suntech Solar Power Co., Ltd., and landed on NASDAQ in 2005, becoming the first private enterprise listed on the main board of the United States.

In 2006, Shi Zhengrong broke into Forbes magazine's "global rich list" with a fortune of 2.2 billion US dollars and won the first place in China. In the same year, Asia silicon was incorporated in Qinghai. At that time, the company had no connection with Shi Zhengrong himself. In 2009, Wuxi Suntech invested in the Asian silicon industry, and Shi Zhengrong came to the front of the Asian silicon industry as a manager.

Since then, with the influence of "double anti" and the fluctuation of photovoltaic industry, Wuxi Suntech went into bankruptcy liquidation in 2013 and delisted from NYSE the following year. At this point, Shi Zhengrong's fate with the capital market has gradually come to an end.

The Asian silicon industry's rush to the science and technology innovation board is also considered as Shi Zhengrong's "continuation of the front line" with the capital market.

However, the problems left over by the history of Wuxi Shangde still have aftershocks. According to the prospectus, Wuxi Suntech is still in bankruptcy liquidation.

In addition, from 2017 to 2019, the operating revenue and net profit of Asia silicon industry declined. The company's revenue decreased from 1.69 billion yuan in 2017 to 1.42 billion yuan in 2019, while the net profit decreased from 360 million yuan in 2017 to 110 million yuan in 2019. Asia's silicon industry said this was mainly due to the continued decline in polysilicon prices.

In the first half of this year, the company's performance rebounded, with operating revenue of 710 million yuan and net profit of 60 million yuan. The good news is that at present, with the production of high cost and old production capacity, the supply and demand of polysilicon market are gradually balanced. Since July 2020, the price of polysilicon is rising rapidly. In the middle of August this year, the price of silicon material once reached 100000 yuan / ton.

For the price of polysilicon, a number of industry insiders said its volatility is more frequent. Asia silicon industry frankly said, "the company's operating performance and profitability are greatly affected by the price changes of polysilicon. Although the price of polysilicon has increased greatly since the third quarter of this year, if the price of polysilicon falls sharply again in the future, the company will face the risk of falling gross profit rate and operating performance fluctuation."

However, according to the latest forecast of silicon industry branch of China Nonferrous Metals Industry Association, "the supply-demand relationship of polysilicon market has shown a trend of gradual reversal. In addition, considering that the increase of silicon material supply in 2021 is far less than that of demand, according to the relatively clear expectation of short supply, it is expected that from December, the downstream will gradually enter the stage of stock preparation, and the price of polysilicon will gradually stabilize.

- Related reading

Zhang Chaoyang, Who Is Not A Good Man, Can Still Bring Sohu Back To The Internet Center?

|

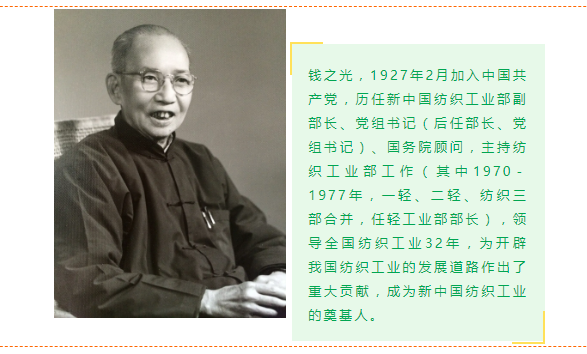

In Memory Of The 120Th Anniversary Of Qian Zhiguang'S Birth, The Founder Of New China'S Textile Industry

|

In Memory Of The 120Th Anniversary Of Qian Zhiguang'S Birth, Qian Zhiguang: Founder Of Textile Industry In New China (1)

|

"Jiang Deyi Era" Of BAIC Group: Can Arcfox Carry Forward The Past And Open Up The Future?

|- Dialogue column | [Lailong Tang Costume] Inheriting The Palace Production Process, Four Generations Of People Have Inherited It

- News Republic | Beijing Road Launched The Second Phase Of Professional Skills Training For Dress Consultants To Help Upgrade The Service Of Clothing Brands

- Law lecture hall | Alibaba Vice President Gu Mai Is Suspected Of Corruption And Taken Away

- Instant news | The Protection Of Intellectual Property Rights Is The Protection Of Innovation

- Industry Overview | Cotton Demand May Start To Increase

- Industry Overview | Guangzhou Xintang Baishengfa Dyeing 70000 Tons Fabric Project Signed In Guangxi

- Industry Overview | Ningbo Textile Enterprises Reach The First "Green Electricity Deal" In Zhejiang

- Industry Overview | Cotton Harvest In Aksu Region Is Coming To An End

- Fabric accessories | Jiaxin Silk (002404): At Present, Bionic Silk Is In The Testing Stage

- Fabric accessories | Puning Customs Strengthen Supervision And Excellent Service To Help Textile And Garment Export Stable

- What Happened To Everbright Securities?

- Crazy Iron Ore: The Price Rises Sharply To A New High In 7 Years, Who Is Behind It?

- Decipher The Territory Of Alibaba'S "Community Group Buying": Investment And Endogenous Multi Line Development

- “人脸识别”背后的渠道商生态

- Help Textile Machinery Industry To Develop

- Aksu: In The First 10 Months, 48 Textile And Garment Enterprises Above The Designated Size Achieved An Industrial Added Value Of 1.09 Billion Yuan

- Zibo Notice 5 Batches Of Unqualified Baby Clothing, Purchase To Recognize These

- International Advantageous Brand Cluster Seminar (Ganzhou) Textile Brand Construction Forum Successfully Held

- "Operation Forum Of Spandex Industry In Post Epidemic Era" Held In Xiaoshan

- How Does The Head Enterprise Make Efforts To Run Through The Whole Textile Process?